The Risks and Realities of Investing in Private REITs

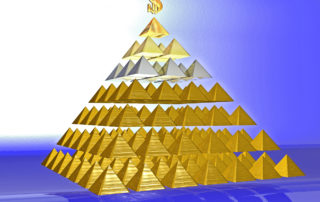

The poor performance of these investments reflects negatively on advisors, suggesting a conflict of interest and puts into question their legally required commitment to serve the best interests of their clients.