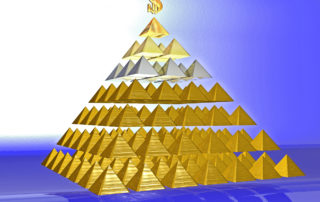

When you’ve worked hard to fund your retirement or your kids’ college fund, and put your trust in a broker and his firm, you should receive compensation if they violate that trust. The Missouri Supreme Court says that stockbrokers owe their customers a fiduciary duty:

This fiduciary duty includes at least these obligations: to manage the account as directed by the customer’s needs and objectives, to inform of risks in particular investments, to refrain from self-dealing, to follow order instructions, to disclose any self-interest, to stay abreast of market changes, and to explain strategies

State ex rel Paine Webber v. Voorhees (Mo. banc. 1995)

So if your broker puts his own interests ahead of yours, and does not manage your account according to your needs and objectives, or fails to inform you about risks in your investments or to explain his strategies, then he may have breached his duties as a fiduciary and you may have a case against him.

Rose Law has experience fighting and winning cases for investors. We recently won a $776,462 award along with attorney Diane Nygaard on behalf of an elderly investor. The investor had placed his trust in Ameriprise and one of its brokers, and an arbitration panel found that Ameriprise had breached its fiduciary duties to the investor by selling him variable annuities and non-publicly traded REITs that generated large fees and commissions for Ameriprise and its broker but did not serve the investor’s best interests.

Rose Law will also pursue claims against employers who fail to fulfill their duties when managing their employees’ 401(k) plans. Your employer has an obligation to provide prudent investments for employees to select from, and if your employer has failed to provide reasonable investment options, and if your are stuck with high fees and expenses in your 401(k) plan, then you may have a claim.

Securities Litigation Specialties

Results

Securities Litigation News

The Risks and Realities of Investing in Private REITs

The poor performance of these investments reflects negatively on advisors, suggesting a conflict of interest and puts into question their legally required commitment to serve the best interests of their clients.

Rose Law Leads the Charge in Investigating GWG L Bonds Mis-selling

In our ongoing efforts to serve investors, Rose Law is representing individuals who purchased GWG L Bonds. These bonds were issued by GWG Holdings, Inc., which defaulted in 2022, significantly impacting numerous investors left holding worthless investments. [...]

GWG L-Bond Concerns Began Long Before SEC Investigates, Meanwhile Investors Were Still Encouraged to Buy

Nearly 27,000 retail investors who are owed approximately $1.6 billion were the last to find out about GWG Holdings, Inc.’s serious financial troubles.

Rose Law Investigates Missouri Broker

As GWG Holdings continues to struggle, investors are left holding the bag on millions of dollars of its failed L bonds. Many of those investors should never have been invested in the risky bonds in the first place.

Brokers Bilk Customers With GWG L-Bonds

GWG L bond investors are facing significant losses as GWG Holdings navigates both bankruptcy and class action lawsuits. Despite the bonds offering high interest dividends, the GWG L Bonds were poorly secured, unlisted and unsellable [...]

SEC Monitor Installed at GPB Capital Holdings

GPB agrees to have an independent monitor oversee the firm’s operations before court forces the issue.